|

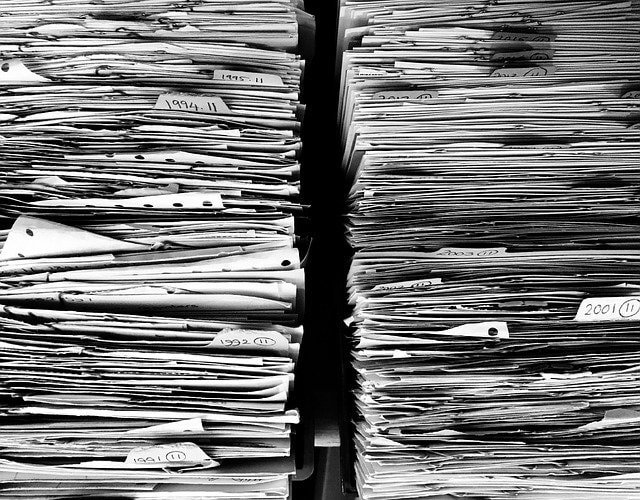

As you are cleaning up and storing your records from the current tax season, or preparing for the upcoming tax season, you may wonder exactly how long you are supposed to keep all of these documents?

The answer of course is that it depends. The IRS recommendations for keeping documents are based on the statute of limitations to amend or audit your return and that period of time can vary based on the situation. Below is a general list of tax documents and guidelines for how long to keep and when you can dispose. These are general guidelines and can vary. If you are involved in a lawsuit, bankruptcy, or other financial dispute, keep documents pertaining to those events forever. At Least a Year Keep monthly accounts statements and pay stubs for at least a year. If they match up with your annual W-2 or brokerage statement you can generally shred these after a year. At Least Three Years You should keep any tax return supporting documents (W-2’s, 1099,’s etc.) for at least three years after the return filing deadline, although many find it easier to just hold all of this for seven years. If you have investments, real estate, or other property you will want to keep the records pertaining to that property until at least three years AFTER it has been sold or disposed. Seven Years Technically you only need to keep certain records (related to worthless securities and/or bad debt deductions) for seven years. However, I generally recommend keeping most supporting documents for seven years, then taking out the tax returns, and shredding the rest in year eight. Forever Keep your filed tax returns forever. Keep ALL your records indefinitely if you do not file a return. Keep all your records indefinitely if you file a fraudulent return. Check out the IRS article on this issue here for more detailed information: When disposing of old documents, remember to always shred or burn sensitive documents including anything with your social security number on it. In addition, as you are organizing, we also recommend maintaining two files/folders of information: First, a Temporary File of tax documents or records for the upcoming tax season. Start a file for all these items at the beginning of the year and then add to it as items come in. That way you will be ready for filing season without having to spend any additional time to search and compile documents. Second, a Permanent File in a fireproof safe or safe deposit box that contains insurance policies, social security cards, passports, will/trust agreements, birth certificates, power of attorney documents, deeds, mortgage information, titles, etc. If you ever have any questions about what to keep, feel free to reach out. This is general information and a brief summarization of complicated tax issues which are often subject to many exclusions and limitations. We make every effort to verify the accuracy of all information but we do not guarantee or warranty advice disseminated over the internet. Please give us a call to discuss potential strategies and ensure they make sense for your specific situation. Comments are closed.

|

Site powered by Weebly. Managed by Lunarpages

RSS Feed

RSS Feed