|

Many strategies to reduce your 2017 tax liability will expire on 12/31/17. It is crucial to review your tax situation prior to the end of the year and implement any potential tax savings measures while you still have the ability to do so. As a business owner there are a myriad of potential planning strategies available. Below are a few of the most common.

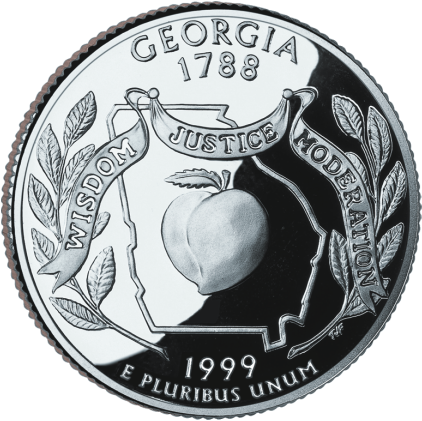

We have also posted a Year End Tax Planning For Individuals article that you can review in conjunction with this article. This is general information and a brief summarization of complicated tax issues which are often subject to many exclusions and limitations. We make every effort to verify the accuracy of all information but we do not guarantee or warranty advice disseminated over the internet. Please give us a call to discuss potential strategies and ensure they make sense for your specific situation. If you are a Georgia resident you may be interested in the popular GA GOAL or GA 529 tax benefits. The GA GOAL scholarship program allows taxpayers up to a $2,500 credit for contributions to the program. The Path2College Georgia 529 Plan allows a deduction of up to $2,000 ($4,000 for joint filers) per year, per beneficiary. See the links below for more details. http://www.goalscholarship.org/ https://www.path2college529.com/ Georgia taxpayers getting close to age 62 may be pleasantly surprised to find out that their state income tax liability can be significantly reduced in retirement. The Georgia Retirement Income Exclusion applies to many forms of retirement income and reduces total Georgia liability to $0 for many retirees. https://dor.georgia.gov/retirement-income-exclusion This is general information and a brief summarization of complicated tax issues which are often subject to many exclusions and limitations. We make every effort to verify the accuracy of all information but we do not guarantee or warranty advice disseminated over the internet. Please give us a call to discuss potential strategies and ensure they make sense for your specific situation. |

Site powered by Weebly. Managed by Lunarpages

RSS Feed

RSS Feed